Founders’ Society

Planning Your Legacy • Supporting AAM’s Endowment • Securing the Future

The Association of Anglican Musicians is a nonprofit organization of musicians and clergy serving the Episcopal Church and the larger Anglican Communion. It qualifies as a charitable entity for federal and state income and estate tax purposes under section 501(c)(3) of the Internal Revenue Code of 1954 (or the corresponding provision of any future United States Revenue Law).

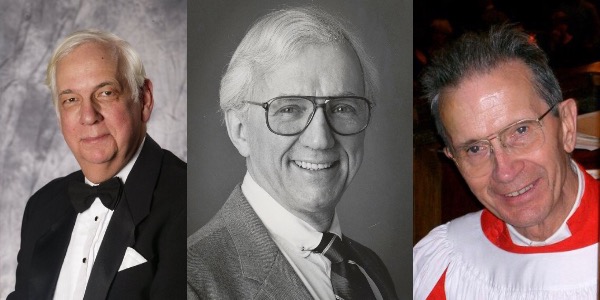

The Association of Anglican Musicians Founders’ Society was officially established by the Board to honor the work and legacy of AAM’s three founding members and first three presidents, Dr. James Litton, Dr. Raymond Glover, and Dr. Gerre Hancock, and is tasked with growing AAM’s endowed funds. It was launched at the Boston Conference in July 2019.

James Litton, Raymond Glover, and Gerre Hancock

The Founders’ Society supports AAM’s Endowment Fund, established to receive, invest, and administer bequests and charitable gifts to the Association. It is managed by Goelzer Investment of Indianapolis, with oversight and advice from AAM’s Investment Committee on behalf of the Board, and currently stands at over $1,000,000 (as of June 2019). Since it began disbursing funds in 1992, over $150,000 has been awarded. The Endowment deals in Environmental, Social, and Corporate Governance investing (ESG) securities, as befits a church-based organization such as AAM.

Your gifts will enable us to:

▶︎ Continue To Award Grants by providing financial assistance for projects or programs that support the mission of AAM. Since its inception, over $93,000 has been awarded. Applications are considered by the Endowment Committee and approved by the Board. Projects that have been supported include AAM’s Conflict and Closure pamphlet, Catalogue of Anthems and Motets, Musicians Called to Serve, funding to Conference committees for commissioning new music, American Sarum, funding for AAM’s presence at General Conventions, the Millennium Survey, A Concise History of the Association of Anglican Musicians, and a new after school choir program at Church of the Holy Apostles, Wynnewood, PA.

▶︎ Continue Supporting The Hancock Internship by partially funding a ten-month intense mentoring, hosted by one of the country’s established music programs. Past Internships have been hosted by Trinity Church, Copley Square, Boston, the National Cathedral in Washington, D.C., Trinity Cathedral in Columbia, SC, Saint Mark’s Episcopal Church, Philadelphia, and Saint James Cathedral in Chicago.

Planning Your Legacy

The choice of an appropriate planned gift vehicle usually provides significant tax advantages to the donor. There are many ways of giving:

▶︎ A Gift in Life — a gift in cash, securities, or other assets, such as tangible objects of value or real estate.

▶︎ A Bequest — provides for loved ones, the Church, and institutions such as AAM that you value through a provision in your will

▶︎ Life Insurance — allows a large gift at a small cost by giving a new or existing policy or by designating the AAM Endowment Fund as beneficiary.

▶︎ Retirement Plan Assets — by donating the residual funds in your IRA, Keough, 403(b) and/or 401(k) retirement plan(s), you can minimize or avoid income and estate taxes while making a significant gift to the AAM Endowment.

Sample Bequest Clauses

▶︎ Gifts for The AAM Endowment Fund

“I give and bequeath the sum of _________ dollars (or stated percentage of estate or remainder) to The AAM Endowment Fund.”

▶︎ Gift of Residuary Estate

“I give, devise, and bequeath the remaining balance of my estate, after all specific bequests and devises have been satisfied, to The AAM Endowment Fund.”

▶︎ Contingent Gift of Residuary Estate

“I give and bequeath to _________ (named individual), the sum of _________ dollar, if he/she survives me. If _________ (named individual) does not survive me, I give and bequeath said amount to The AAM Endowment Fund.”

In addition to making gifts of cash in the form of a specific amount or percentage, you may also opt to bequeath the following types of property to The Founders’ Society:

- Stock or other intangible personal property, such as royalties

- Real estate

- Personal property (art, antiques, etc.). Such gifts must be accepted by the AAM Board specifically.

The Book of Common Prayer reminds us that it is our duty as Christians to have a will to provide for the well-being of our families, our Church, and other charitable organizations (BCP, page 445).

Careful estate planning will convey your final wishes for the distribution of your assets.

Please take this opportunity to plan for a cause close to your heart, the Endowment Fund of the Association of Anglican Musicians and help safeguard the future of the tradition that we all hold so dear.

Inviting Bequests to grow the AAM Endowment Fund

2022–2023 Committee Members

Joseph Arndt — Chair (’24)

Margaret Secour (’23)

M. Brett Patterson (’23)

Ernest Plunkett (’25)

Patrick A. Scott, D.M.A. (’24)

Bradley Upham (’25)

Joseph M. Galema, D.M.A., ex officio

Sonya Subbayya Sutton, ex officio

For general inquiries, please email the chair of the Planned Giving Committee, Joseph Arndt.